Employing this approach can be high-risk because life is unpredictable. While you may have the ability to pay for to make accelerated repayments currently, if you get sick, lose your job, or the boiler goes, that might no more be a choice. Obtaining an adjustable-rate mortgage is very appealing to mortgage debtors who have, or will have, the cash to repay the car loan prior to the brand-new rates of interest kicks in. While that does not include the vast bulk of Americans, there are circumstances in which it may be possible to draw it off.

- The 2nd number refers to just how frequently the price readjusts after the first 5 years.

- It can lead to a payment that's 3 times the initial amount.

- The more factors you pay, the less rate of interest decrease you get for your cash.

- Fixed-rate mortgages have preserved lower levels of activity than ARMs, yet by the start of the second quarter of 2020, the former took the lead.

- If the ARM is held enough time, the rate of interest will surpass the going rate for fixed-rate lendings.

With a 30-year term, that would lead to varying repayments based upon changing rate of interest for 23 years after the initial fixed-rate duration runs out. Variable-rate mortgages, on the various other hand, begin with a reduced set rate of interest for 5, 7 or 10 years, and then change the price regularly afterwards. The first fixed rate of interest on our ARMs is usually lower than the corresponding 30-year fixed rates of interest.

Repaired

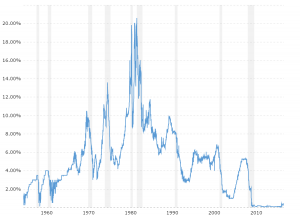

ARM interest rates are based upon a combination of variables, including today's home mortgage rates, the Safe Overnight Financing Rate index and also caps. Then the rate of interest adjusts every 6 months for the staying 20 years. An ARM loan has an interest rate that transforms based on the market, while a fixed-rate funding's rates of interest stays the same with the lifetime of the financing. In 2006, prior to the subprime home loan situation, http://myleskuvc230.wpsuo.com/exactly-how-to-come-to-be-a-mortgage-broker over 90% of the subprime home mortgages (which accounted for 20% of all home loans) were adjustable-rate mortgages. Inside business caps are expressed most often by simply the three numbers involved that represent each cap.

Other Types Of Arms

For many people, the preliminary fixed-rate period matches how much time they'll be in their home prior to they relocate or re-finance. Germain Vault Institutions Act of 1982 enabled Adjustable rate home mortgages. Option ARMs are best matched to advanced borrowers with expanding revenues, especially if their earnings change seasonally as well as they require the repayment adaptability that such an ARM may give. Innovative debtors will carefully take care of the level of unfavorable amortization that they enable to accumulate. The arrangement with the lender may have a clause that permits the purchaser to transform the ARM to a fixed-rate home mortgage at marked times.

When ARM rates adjust, the new price is based upon a rate index that reflects current lending problems. The new rate will be the index price plus a certain margin developed at the time you took out the lending. So if the index is at 3.5 percent when your price readjusts as well as your margin is 2 percent, your brand-new price will be 5.5 percent. Convertible ARM have the choice of converting their ARM right into a fixed-rate home mortgage at Have a peek here a time assigned in the home mortgage contract. Property owners appreciate low initial prices along with the assurance that features having a fixed-rate option. When the fixed-rate portion of the term mores than, the ARM changes up or down based upon existing market prices, based on caps regulating how much the rate can go up in any type of certain modification.

If you can't make the settlements after the fixed-rate phase of the finance, you can lose the house. The Rocket Mortgage Knowing Center is devoted to bringing you posts on home acquiring, financing types, home mortgage essentials as well as refinancing. We additionally use calculators to identify home affordability, home equity, regular monthly home loan repayments as well as the advantage of refinancing.

There are a few situations where an ARM car loan might make sense over a conventional, fixed-rate home loan. As an example, an ARM loan could be much more useful if you're not intending on staying in your home for greater than 5 to ten years or you can afford to repay your home mortgage prior to the price modifications. Additionally, those looking to get a jumbo funding may benefit from an ARM funding due to the fact that the difference between set as well as flexible price often tends to be bigger. This takes place whenever the monthly home loan repayments are not big sufficient to pay all the rate of interest due on the home loan. This might be caused when the timeshare solution repayment cap contained in the ARM is low enough such that the principal plus interest payment is greater than the payment cap.

Likewise contributing to the turn-around is the reality the financing industry is supplying more tasty variations of the product to consumers. Today's "crossbreed ARMs" offer a break on rate of interest as well as a set repayment quantity for the initial duration before going back to adjustable rates at the 3, 5, 7 or 10-year mark. However, for certain homebuyers - particularly those expecting to move again in a couple of years - they're a wonderful item. If you're a regular homebuyer looking for a conventional home mortgage from a mainstream lending institution or lending institution, you owe it to on your own to at the very least inspect them out. As interest rates go down, there tends to be a constricting of the return contour. This obtains a little bit technological, but essentially the return contour take care of the distinction in between set- and also variable-rate mortgages.